ETH Price Prediction: Consolidation Before Next Rally?

#ETH

- Technical Outlook: ETH tests lower Bollinger Band with MACD suggesting potential reversal

- Institutional Demand: ETF flows and BlackRock speculation counterbalance miner sell pressure

- Ecosystem Risks: Regulatory actions (Tornado Cash) and smart contract exploits remain headwinds

ETH Price Prediction

ETH Technical Analysis: Short-Term Bearish Pressure Amid Long-Term Bullish Signals

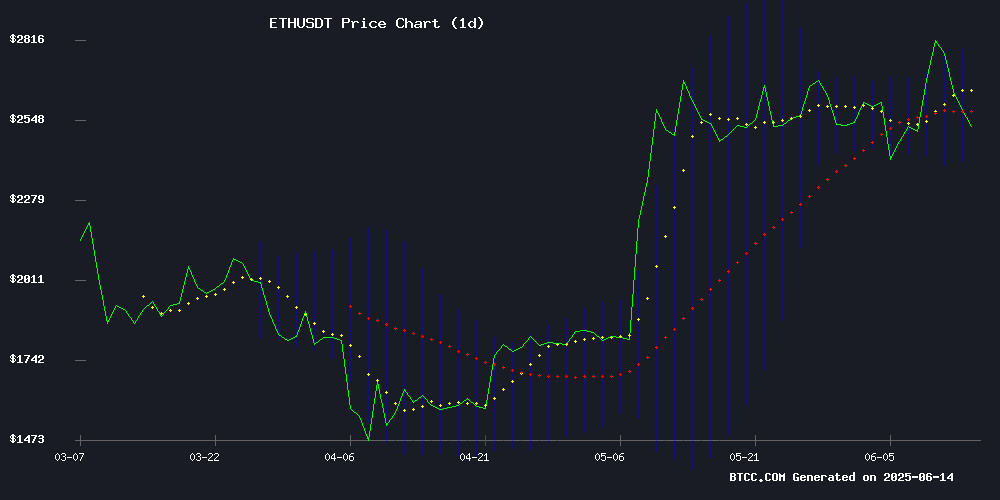

ETH is currently trading at $2,536.29, below its 20-day moving average of $2,594.77, indicating short-term bearish pressure. The MACD shows a positive but narrowing momentum (12.9851 vs 9.2375), while Bollinger Bands suggest consolidation between $2,405.76 and $2,783.78.says BTCC analyst Michael.

Mixed Sentiment as Ethereum Faces Institutional Inflows vs. Regulatory Headwinds

While ethereum ETFs saw their first outflows after record inflows, BlackRock ETF speculation fuels $5K price targets.notes Michael. Whale movements into presales and Vitalik''s advocacy add layers to ETH''s narrative.

Factors Influencing ETH’s Price

Ethereum ETFs See First Outflows After Record Inflow Streak

U.S. spot Ether ETFs recorded their first net outflows on June 13, marking an end to a 19-session inflow streak that began on May 16. The streak brought in $1.37 billion, accounting for roughly 35% of total inflows since the products launched in July 2024. Despite robust demand, Ether''s price declined from $2,620 to $2,552 during the period, suggesting buying pressure failed to catalyze upward momentum—even a $240 million single-day inflow on June 11 had negligible impact.

Analysts attribute subdued price action partly to the ETFs'' lack of staking functionality, a limitation BlackRock has openly acknowledged as suboptimal. Meanwhile, institutional interest persists: SharpLink Gaming''s $463 million ETH purchase on June 13 made it the largest public holder of Ether, underscoring conviction among corporate buyers even as retail flows wane.

Historical data shows Q3 typically underperforms for ETH, averaging sub-1% returns. Yet some see potential as Ethereum trails Bitcoin''s rally, with Optimism gaining traction despite near-term headwinds.

RIMining Offers Limited-Time 20 ETH Reward to New Users

RIMining, a UK-based cryptocurrency cloud mining platform established in 2014, is rolling out a global promotion targeting new users. The initiative promises 20 ETH (~$50,000) in cloud computing rewards for registrants, requiring no hardware investment or technical expertise. The platform claims mobile accessibility for daily mining operations.

With 190 mining farms across 180 countries operating 16 million rigs, RIMining positions itself as a gateway for passive crypto income. The onboarding process involves account creation ($15 signup bonus) and selection of computing power contracts. While emphasizing accessibility, the offer''s sustainability remains unverified amid fluctuating ETH valuations.

Ethereum ETF Inflows Signal Institutional Confidence Amid Price Rally

Institutional interest in Ethereum has surged, with over $14 billion now locked in ETF products. Analysts view ETF inflows as a critical indicator of market direction, reflecting smart capital positioning for upward momentum. CoinShares reports $296 million in Ethereum product inflows last week—the strongest since the U.S. election—marking seven consecutive weeks of growth.

ETH''s price stability near $2,700 suggests consolidation before a potential breakout. A move above $3,000 could catalyze a short-term rally toward $3,500, with further upside if resistance breaks. Network upgrades and ETF adoption are reinforcing Ethereum''s fundamental strength, aligning with bullish sentiment.

Tornado Cash Developer Alleges DOJ Obstruction in Fair Trial Preparations

Roman Storm, co-founder of privacy protocol Tornado Cash, claims the U.S. Department of Justice is systematically undermining his defense ahead of a critical July trial. Prosecutors rejected five of six proposed expert witnesses—including blockchain analyst Matthew Edman—while imposing restrictive conditions on the sole permitted testimony.

The case stems from 2023 sanctions against Tornado Cash, which authorities allege facilitated money laundering for North Korean hackers. Storm maintains the non-custodial smart contract cannot be controlled by developers. "They want to bury DeFi," he tweeted, accusing regulators of demanding impossible Know-Your-Customer controls on immutable code.

DOJ filings dismiss expert analyses of Ethereum''s architecture and privacy tech as irrelevant to sanctions violations. This evidentiary battle could set precedents for developer liability across decentralized finance—particularly for ETH-based protocols.

Ethereum Foundation Backs Tornado Cash Co-Founder with $500k Legal Donation Ahead of Pivotal Trial

The Ethereum Foundation has committed $500,000 to support Roman Storm''s legal defense as the Tornado Cash co-founder faces charges from U.S. authorities. The foundation frames the case as a critical battle for privacy rights in decentralized finance, arguing that writing code shouldn''t be criminalized.

While OFAC lifted sanctions against Tornado Cash in March 2025 following a court reversal, Storm still confronts three serious charges including money laundering conspiracy. The July 14 trial could set important precedents for DeFi development and regulatory boundaries.

With legal costs projected to reach $2 million, the cryptocurrency community watches closely. The outcome may influence how governments approach privacy tools in blockchain ecosystems and shape the future trajectory of decentralized finance innovation.

Ethereum Whale Shifts Funds to Kaanch Presale Amid ETH Performance Concerns

A significant Ethereum holder has reallocated capital into the Kaanch Layer 1 presale at $0.32 per token, signaling waning confidence in ETH''s near-term prospects. The move follows Ethereum''s failure to sustain momentum after its 2021 peak at $4,600, with whales increasingly seeking high-growth alternatives.

Kaanch''s sixth presale stage has attracted $2.13 million in funding, with analysts projecting potential 20,000% returns post-listing. The project''s limited 58 million token supply and live staking offering 30% APY position it as a scarcity-driven investment. Security audits by SpyWolf and VerifyLab provide institutional-grade validation for this emerging Layer 1 solution.

SharpLink Gaming Stock Plummets 70% After S-3 Filing Sparks Dilution Fears

SharpLink Gaming, the first company to formally adopt Ethereum as a treasury asset, saw its shares collapse over 70% in after-hours trading following an S-3 filing with the SEC. The registration statement allows the sale of approximately 59 million common shares, including pre-funded warrants and other instruments, triggering panic over potential dilution.

Market participants reacted violently to the prospect of nearly 58.7 million new shares flooding the market if all warrants are exercised. The filing explicitly permits existing investors—not the company—to offload holdings, accelerating the sell-off as traders priced in imminent devaluation.

Despite SharpLink''s attempts to clarify the mechanics of the offering, the damage was done. The stock remains down roughly 70% as of latest data, underscoring how crypto-adjacent equities remain vulnerable to traditional market forces—even when backed by innovative treasury strategies involving assets like Ethereum.

Sharplink Gaming''s Ethereum Bet Triggers Historic 91% Stock Collapse

Sharplink Gaming''s stock imploded in a spectacular reversal, shedding 91% of its value in two weeks after peaking at $124. The descent accelerated during after-hours trading, with shares plummeting from $33 to under $11 amid frenzied selling. Trading volume exploded to ten times normal levels, signaling panic among investors.

The crash coincided with an SEC filing registering 58 million shares for potential resale, stoking fears of massive dilution. This followed Sharplink''s controversial pivot to building an Ethereum-based treasury, having raised $450 million for ETH acquisitions. Market participants interpreted the registration as a harbinger of impending sell pressure from early investors.

Joe Lubin''s association with the Ethereum strategy added fuel to the fire. The co-founder''s reputation as an ETH pioneer initially buoyed confidence, but the extreme volatility has raised questions about corporate crypto treasuries. The episode marks one of the most dramatic boom-to-bust transitions in recent market history.

Vitalik Buterin Advocates Ethereum as Resilient Alternative Amid Nordic Cash Reassessments

Sweden and Norway are reversing their cashless trajectories after identifying critical vulnerabilities in centralized payment infrastructures. Ethereum co-founder Vitalik Buterin positions decentralized networks as a robust contingency during systemic failures, emphasizing the need for enhanced privacy and reliability in blockchain systems.

Norway''s dependence on the Vipps mobile payment app during crises has exposed fragility in digital-only frameworks. While Sweden''s cash usage dwindled to 1% of transactions, geopolitical instability—particularly the Ukraine conflict—has prompted mandatory cash reserves as a hedge against cyberattacks and infrastructure collapse.

Buterin''s intervention spotlights Ethereum''s potential to serve as a digital fail-safe, though industry debate persists regarding its offline functionality. The Nordic pivot underscores growing institutional recognition of blockchain''s role in financial system resilience.

DeFi Platform Cork Protocol Loses $12M in Smart Contract Exploit

Cork Protocol, a decentralized finance platform backed by a16z crypto and OrangeDAO, suffered a $12 million exploit involving wrapped staked ether (wstETH). Blockchain security firm Cyvers detected the breach, tracing it to a malicious contract deployed by a suspiciously funded wallet. The stolen wstETH was swiftly converted to ETH.

The platform confirmed the incident affected its wstETH:weETH market, prompting a precautionary pause of all other markets. Security auditor Debaub suggested the attacker manipulated the smart contract''s exchange rate using counterfeit tokens.

Ethereum Price Eyes $5K as BlackRock ETF Speculation Fuels Rally

Ethereum''s 48% surge since May 8 to $2,675 positions ETH for a potential assault on $5,000 in 2025. The rally gained momentum after BlackRock included a staked Ethereum ETF in SEC meeting documents, signaling institutional interest.

Analyst Javon Marks forecasts an 81% upside to $4,811, with $8,500 achievable if bullish momentum sustains. The market now watches whether ETH can consolidate gains before challenging its all-time high.

Is ETH a good investment?

| Metric | Value | Implication |

|---|---|---|

| Price | $2,536.29 | Below 20MA (-2.25%) |

| MACD Histogram | +3.7475 | Bullish momentum fading |

| Bollinger %B | ~0.4 | Near oversold territory |

Michael suggests: "ETH''s institutional inflows (ETFs) and strong developer activity offset short-term technical weakness. Dollar-cost averaging into dips may be prudent."

See HTML table for key metrics.